cryptocurrency tax calculator us

Crypto Tax Calculator. Cryptocurrency tax calculators work by retrieving data from your exchanges wallets and other cryptocurrency platforms.

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Tax-Loss Harvesting With A Crypto Tax Calculator In general terms losses resulting from cryptocurrency trades are tallied against any gains.

. Select the tax year you would like to calculate your estimated taxes. US Dollar Australian Dollar etc. How to calculate tax on income from cryptocurrency.

Over one million people trust FTX to buy sell cryptocurrencies. Stay focused on markets. February 12 2022 by haruinvest.

You are liable for capital gains tax on the amount if any that your original holding appreciated in value. We offer full support in US UK Canada Australia and partial support for every other country. Taxpayers can file their taxes between Jan.

Well Help You Track Your Cryptocurrency Transactions And Report Them In The Right Forms. Hence he will be liable to pay tax 30 on the net income of US 60000 which shall be US 18000 ie. To do your cryptocurrency taxes you need to calculate your gains losses and income from your cryptocurrency investments in your home fiat currency eg.

Let us handle the formalities. The cryptocurrency tax calculator USA is an easy online tool to estimate your taxes on short term capital gains and long term capital gainsThe calculator is based on the principle. Depending on your tax bracket for ordinary income tax.

An IRS 8949 cryptocurrency tax form must be filled out for every sale or transfer of mined cryptocurrency. Select your tax filing status. You can check out our Free Cryptocurrency Tax Calculator which will answer all of your questions concerning cryptocurrency Bitcoin other alt-coin transactions and provide an.

Ad From Simple To Complex Taxes Filing With TurboTax Is Easy. In the United States you are required to record the value of the cryptocurrency in your local currency at the time of the transaction. Sign up with FTX today.

You can use this calculator to get a quick estimate of the taxes you may owe. What crypto actions are taxable events in the United States. Filing your taxes is already complicated but it can be more confusing if you have bought or sold.

Ad From Simple To Complex Taxes Filing With TurboTax Is Easy. Citizen that dabbled in cryptocurrency over the 2021 tax year will now be expected to file a tax return to the IRS. Just like other forms of property like stocks bonds and real-estate.

Selling cryptocurrency for fiat US. Do you pay taxes on crypto. In the US cryptocurrencies like Bitcoin are treated as property for tax purposes.

You have investments to make. Welcome to your cryptocurrency tax guide. They compute the profits losses and income from your investing.

Well Help You Track Your Cryptocurrency Transactions And Report Them In The Right Forms. Ad Confidently buy and sell cryptocurrency on the FTX app built by traders for traders. Suppose John earned 020 BTC from mining on a day when.

Yes youll pay tax on cryptocurrency profits in the US. Zen Ledgers Bitcoin Crypto Tax Calculator. This is a simplified calculator to help you calculate the gains of your cryptocurrency.

How do I calculate tax on crypto to crypto transactions. The basics of crypto taxes. Cryptocurrency Tax Calculator.

How much tax you pay will depend on how long you hold your Bitcoin. 24 July 2019. Youll pay up to 37 tax on short.

Capital gains tax events involving cryptocurrencies include. Enter your taxable income excluding any profit from Bitcoin sales. Crypto tax calculators work by aggregating your data and then automatically linking your cost bases to your sales using accounting methods like FIFO or LIFO.

Selling a cryptocurrency or digital asset for fiat currency is a taxable event.

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

You Should Know That Crypto Com Have Their Own Free Crypto Tax Calculator R Cryptocurrency

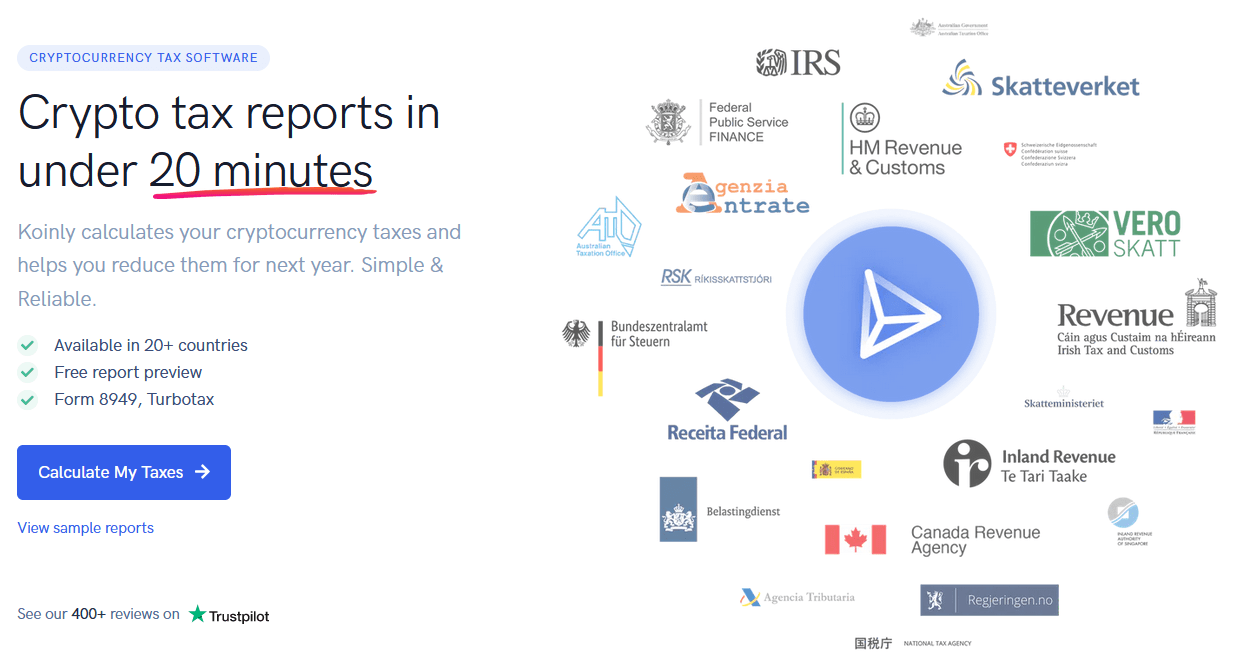

Us Eofy Crypto Tax Prep For Irs Deadline 2022 Koinly

5 Best Crypto Tax Software Accounting Calculators 2022

How To Calculate Cost Basis In Crypto Bitcoin Koinly

Defi Tax Usa Irs Defi Crypto Tax Guide Koinly

![]()

Cointracking Crypto Tax Calculator

10 Best Crypto Tax Software 2022 Selective

Crypto Tax Rates Complete Breakdown By Income Level 2022 Cryptotrader Tax

5 Best Crypto Tax Software S Top Bitcoin Tax Calculator 2022 Coinmonks

![]()

Cointracking Crypto Tax Calculator

Calculate Your Crypto Taxes With Ease Koinly

What S Your Tax Rate For Crypto Capital Gains

Irs Crypto Tax Forms 1040 8949 Koinly

Capital Gains Tax Calculator Ey Us

I Ve Tried Crypto Tax Software So You Don T Have To R Cryptocurrency